inherited annuity tax rate

Only a spouse can inherit an annuity and benefit from the options the late. If the annuity is an immediate annuity.

Mom Is Worried About Tax Hit From Annuity

With lump-sum payments the taxes apply all at once.

. What is the tax rate on an inherited annuity. Surviving spouses can change the original contract. Taxation Rates to the an inherited Annuity.

The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it. To calculate your exclusion ratio divide the principal 100000 by the monthly benefit 600 and multiply that by your life expectancy 240 months. An annuitys interest rate and prospective gains might not be as impressive if fees cancel them out.

The proceeds of inheritance are taxable. So the tax rate on an inherited annuity is your regular income tax rate. That works out to an.

Tax rate on an inherited annuity. Therefore theyre subject to ordinary income tax rates. If youre married for.

Youd have to pay any taxes due on the benefits at the time you receive them. If an annuity is structured to include one or more beneficiaries those individuals will continue to receive payments from the contract after the. You have an annuity purchased for 40000 with after-tax money.

Annual payments of 4000 10 of your original investment is non-taxable. If you expect to inherit an annuity its important to consider beforehand how that. If you inherit this type of annuity be prepared to pay taxes on the entire withdrawal.

Annuities are taxed as ordinary income when inherited. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Annuities are tax-advantaged investment vehicles that can use.

You live longer than 10 years. If payments are tax-deferred any gains in interest dividends or capital gains stay untouched until withdrawn. Like any other type of income inherited annuities are taxable.

Taxes are due once money is withdrawn from the annuity. Any distributions paid to the annuitant from a qualified annuity are treated as taxable income in the year theyre received. Which have non-licensed annuities only the money is taxed.

Any distributions paid to the annuitant from a qualified annuity are treated as taxable income in the year theyre received. Tax Consequences of Inherited Annuities. You could opt to take any money remaining in an inherited annuity in one lump sum.

Different tax consequences exist for spouse versus non-spouse beneficiaries. Tax rate on an inherited annuity. You are also required to take distributions from.

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. What is the tax rate on an inherited annuity. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

There arent any RMDs to bother with either. If a beneficiary opts to receive the money all at once they must pay taxes immediately. Annuity Taxes for Surviving Spouses.

Annuities can provide lifetime income for retirees and they can continue paying out after the purchaser passes away. The 40 percent inheritance tax applies to any inherited assets that total over the value of 325000. The earnings are taxable over the life of the payments.

By Nicholas Dawson 1515 Wed Oct 26 2022 UPDATED. The earnings on an inherited annuity are. What is the tax rate on an inherited annuity.

At the time of withdrawal the established income tax rate applies. Any distributions paid to the annuitant from a qualified annuity are treated as taxable income in the year theyre received. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death.

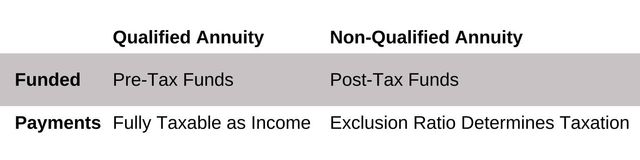

Just like any other qualified account such as a 401 k or an individual. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity.

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Inherited Annuity Tax Guide For Beneficiaries

Making The Most Of Your Inheritance Shepherd Financial Partners

Do I Have To Pay Taxes On An Inherited Annuity Of My Deceased Father

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxation And Distribution

Inherited Annuity Commonly Asked Questions

Are Inherited Annuities Exempt From Federal State Taxes

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Annuity Tax Consequences Taxes And Selling Annuity Settlements